Are there any lenders taking bad credit businesses with guaranteed approval in Australia?

There are a lot of bad credit businesses in Australia which desperately need a quick injection to their cashflow. Banks are irrelevant for them now, or perhaps have been irrelevant for a long time, and these business owners are looking for an unsecured business loan from a private lender.

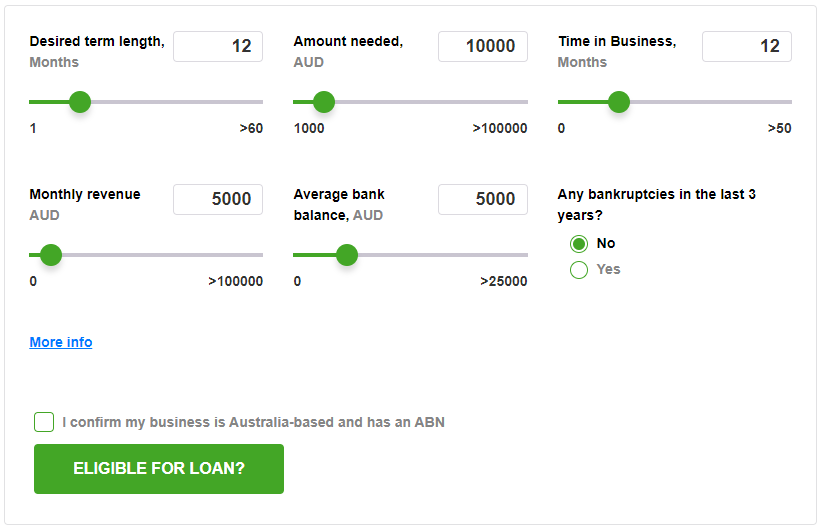

This is not a requirement which is specific to any particular industry or region in Australia. If you look at our business loan industry research you will see that many of the businesses who use the Become financing platform (a loan matching platform for quick lending) come from a variety of industries, are businesses of all size, and have unique financing requirements.

Bad credit business lending blossoms in Australia

There is a very large selection of online lenders in Australia which can be applicable for small businesses with a less-than-perfect business credit score! None of them offers a “guaranteed approval” loan, simply because that’s not how it works in real life, but relatively they are more receptive to bad credit scores, especially in comparison with banks.

Variable

3 months to 5 years

- Flexible Term

- Options for Fixed or Floating Term Loans

- Flexible Repayment Terms

- Secured or Unsecured

up to $15,000

Repayment up to 3 years

- They deliver extremely fast and reliable service

- A high level of transparency

- Friendly, helpful, and well-trained staff that is always ready to assist.

- Low rates

- Quick processing and approval.

$1,000 – $20,000

Up to 60 months

- 60 minutes of loan approval.

- Instant financing means funding your bank account on the same day.

- Repayment terms to suit your cash flow.

- Competitive interest rates.

- Loans secured by vehicles, property, and other assets.

- Non payment or No early repayment fees.

- Flexible lending criteria with loans assessed by our friendly staff, not computers.

- Online digital signature for simple loans.

- We are a responsible lender.

- Member of Independent Ombudsman for your protection.

$20,000 – $500,000

6 months to 5 years

- Flexible Terms

- Fast Loan Approval

- Unsecured Business Loans

- Committed Loan Consultants

$2000 – $100,000

1 Month – 7 Years

- Flexible loan terms. Loan terms of up to 7 years are available depending on what you use as security, with the ability to make repayments weekly, fortnightly or monthly. You can change your payment date at any time.

- Fixed rate. The interest rate you are allocated when you apply for the loan will stay the same for the length of your loan.

- Bad credit applicants welcome. Even if you have a bad credit history, you may be successful in applying for a loan if you have security and can afford the repayments. In some cases, a guarantor may be required.

- Range of interest rates. Interest rates range from 9.95% – 16.95% p.a., and the rate you receive will depend on your level of risk, credit history and security offered. If you have a low level of risk and a good credit rating, you may receive a lower interest rate for your loan.

- Same day approvals. In many cases, loans are approved and paid out on the same business day, provided all information and documentation is received in a timely manner.

$2,000 up to $100,000

12 – 60 months

- Simple application. Applying for an Oxford Finance loan is a simple process.

- Flexible payments. With an Oxford Finance loan, you can choose a repayment schedule to suit. Weekly, fortnightly or monthly options are available.

- Loan terms. Loan terms range from 12 – 60 months. You can pay the loan off sooner if you are able to, but be aware that you may be charged early settlement fees.

- Security. Security for your Oxford Finance loan can be a car, boat or property, or a third party guarantee may be possible for business loans.

- Pre-approval. If you haven’t found the vehicle or boat that you want yet, you can apply for pre-approval so that you can shop with confidence. Pre-approvals are valid for 14 days.

- Fee transparency. Oxford Finance provides a schedule of fees on its website so you can understand what charges you may be subject to.

$3,000 to $250,000

6 months to 5 years

- Personalised interest rates. Interest rates start at 6.85% p.a. for secured personal loans. Secured business loans come with an interest rate of 6.85% p.a. or 7.95% p.a. for unsecured loans. You can call for an estimate based on your circumstances before you make an official application.

- Loan term. Loan terms range from 6 months to 5 years.

- Loan amount. You can borrow from $3,000 to $250,000 if you have an asset to use as security.

- Fast decisions. Nobilo Finance aims to give you a decision on your application within one hour.

- Same-day payouts. Provided your loan documents are signed before 1pm, Nobilo Finance can transfer your loan funds on the same day.

- Pre-approval. If you are purchasing a new vehicle, you can apply for pre-approval so you know how much you have to spend.

- Cool-down period. After you have signed your loan contract, you have five days to review the agreement.

- Charity donation. A portion of your establishment fee will be donated to a charity of your choice.

$5,000 to $500,000

Secured and Unsecured Business Loans

- Various loan amounts. With Mint Finance you can borrow from $5,000 to $500,000 depending on what you need the finance for and your current business standing.

- Loan term. Loan terms range from 6 months to 5 years.

- Interest rate. Interest rates start at 8% p.a. for secured loans with a maximum rate of 19.95% for unsecured loans.

- Time to finance. You can receive your funds within 48 hours of your loan being approved.

- Repayments. Depending on the type of finance, you will make monthly or quarterly repayments by direct debit from your chosen bank account.

$1,000 to $50,000

3-12 Months

- Personal loans from $1,000 to $50,000 for a wide range of purposes

- Tailored interest rates dependent on your credit score and income

- Pre-approved loan so you know what you can afford

- Breakdown and payment protection insurance for car loans

- Available to bad credit applicants and beneficiaries

$5,000 to $350,000

- Low starting interest rate

- Pensioners can be approved

- Student and work visa applications accepted

- Online application

- Maximum interest rate is higher than average

- Loan not funded directly by Finance bloom